Target Audience

In this chapter

The second part of firm research involves defining its target audience.

Organisations & client groups

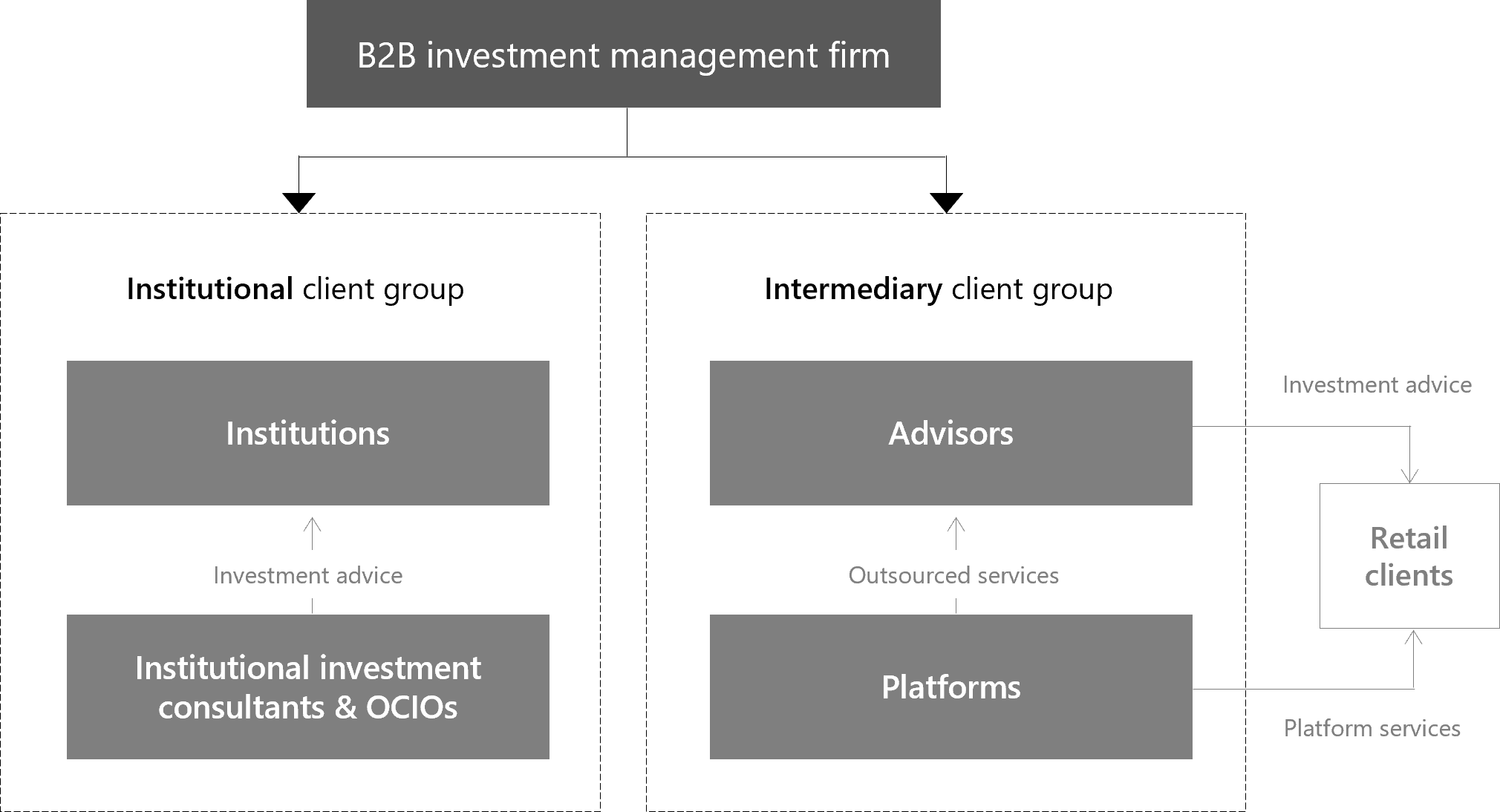

B2B investment management firms typically work with four main types of organisations, commonly grouped into two client groups: institutional and intermediary. These relationships are visualised in figure 1.

Figure 1: Target organisations for B2B investment managers

Institutional clients

- Institutions — an entity that invests on behalf of itself or others, such as pension funds (investing contributions of plan participants), insurance firms (premiums paid by customers), and sovereign wealth funds (oil revenues).

- Institutional investment consultants & OCIOs — organisations that provide outsourced investment expertise (e.g. asset allocation, manager selection) to institutions that lack the necessary in-house capability.

Intermediary clients

- Financial advisors & wealth managers — professionals or firms that provide investment advice and portfolio management to retail investors. These may be independent or part of larger organisations such as private banks.

- Investment platforms — online services that either offer portfolio management and model portfolio services to advisers who outsource the work or provide retail investors with access to pooled funds from multiple managers in a single place.

Key individuals (contacts)

Professionals at B2B investment managers interact with many people across target organisations, but the sales team will focus on those who can allocate money (directly or indirectly) into the firm's products.

These individuals perform the following roles:

- Provide investment advice — client-facing advisors who work with retail investors (e.g., financial advisors, wealth managers, private bankers) or institutions (e.g., field consultants)

- Perform manager research or fund selection — research and select investments used by advisors or for investment platforms (e.g., fund selectors, manager research analysts)

- Construct and manage investment portfolios — devise investment strategies, allocate assets, and construct portfolios

Task

Confirm and document which target organisations and key individuals are relevant for your firm.